&l;p&g;&a;ldquo;Don&a;rsquo;t put all your eggs in one basket.&a;rdquo;

We&a;rsquo;ve all heard this advice, and the same can be said for investments.

Some people attempt to diversify by having a mix of stocks, bonds, and mutual funds. While this is better than owning shares of stock from only a few companies, it doesn&a;rsquo;t provide much diversification, given you&a;rsquo;re still in the narrow classes of equities and bonds.

&l;img class=&q;size-large wp-image-510&q; src=&q;http://blogs-images.forbes.com/impactpartners/files/2018/05/GettyImages-496851962-web-1200x800.jpg?width=960&q; alt=&q;&q; data-height=&q;800&q; data-width=&q;1200&q;&g; Many are seeking ways to earn more on their money than they will at the bank, avoiding the volatility of the stock market for part of their portfolio.

With this in mind, many are seeking ways to earn more on their money than they will at the bank, avoiding the volatility of the stock market for part of their portfolio. Smart investors have been turning to annuities for some of their money.

Over one million Americans own annuities,&l;a href=&q;http://callancapital.com/annuity-investing-does-it-make-sense-for-high-net-worth-investors/&q; target=&q;_blank&q; rel=&q;nofollow&q; &g;&l;sup&g;1&l;/sup&g;&l;/a&g; purchasing billions of dollars of new ones every year.&l;a href=&q;https://insurancenewsnet.com/oarticle/total-annuity-sales-continued-decline-2017-limra-reports&q; target=&q;_blank&q; rel=&q;nofollow&q; &g;&l;sup&g;2&l;/sup&g;&l;/a&g; People own trillions of dollars&a;rsquo; worth of annuities.

Annuities have certainly evolved over the years and now contain some better options to help people achieve their financial goals. Long gone are the days when you automatically lost access to all your money when you purchased an annuity. These new versions retain cash value and give you access to your money. Some include extra money for nursing-home or long-term care, while others might provide for a larger death benefit option.

It&a;rsquo;s easy to see why annuities continue to gain popularity.

With the basics in mind, annuities can be structured for safer growth of your money and/or lifetime income options. Let&a;rsquo;s compare the two:

&l;strong&g;Safer Growth&l;/strong&g;

Fixed annuities will pay a fixed rate of return, usually higher than what the banks will pay, while indexed annuities will pay a return that is &a;ldquo;indexed&a;rdquo; to different markets (U.S. stocks, bonds, gold, etc.), with no risk of stock market loss to your principle.

Your account value in the annuity can only increase and will not decrease due to market losses. This can help provide added peace of mind for those who want some added protection to their portfolio, especially in this ever-changing global economy and 24/7 news cycle. Of course, these products are subject to the claims-paying ability of the insurer.

&l;strong&g;Lifetime Income Option&l;/strong&g;

You and/or your spouse can enjoy the benefits of a monthly income stream for the rest of your life, or a certain period, if you prefer. Even if the annuity account does not have any money remaining in it in the future, the annuity company will pay out for your lifetime, when structured correctly.

People might choose this option to increase their monthly income in addition to Social Security, pensions, rental income, or dividends. Annuities can allow you to begin income payments immediately or defer in the future to increase the payments.

Whether you&a;rsquo;re looking for safer growth of your money or a lifetime income, both options usually contain a death benefit payable to your beneficiaries.

The value of the annuity would be worth the amount you deposit into your annuity account, plus potential growth, and then minus any payments/withdrawals and minus fees. Bear in mind that some indexed annuities have fees of 1% or less, while most fixed annuities usually have no fees.

Over the years, I&a;rsquo;ve seen annuities gain anywhere between 3% and 10% in value. Depending on the annuity terms and conditions, these gains could be higher or lower. The reason fixed and indexed annuities are popular choices for some is the principal protection they offer; volatility in the stock market would not have a negative impact.

Variable annuities are also an option but usually carry higher fees, and your principal is at risk in the market. They contain different terms and might not be attractive to people seeking safety for their money. Some people who previously owned variable annuities found it advantageous to transfer their money to fixed or indexed annuities to reduce fees and risks.

Working with a qualified financial professional can help in your research. Somebody with access to multiple annuity options can help you determine which annuity is worth some of your investment dollars.

Find which company and options are best for you. Some financial professionals have access to special annuity options that others might not have access to. Just like you enjoy the benefits of a professional pilot to fly you safely from point A to point B, a financial professional can help you navigate your way through the options available to you.

True diversification in your portfolio means having some of your money invested in different asset classes outside of the usual mix of stocks and bonds. There are other options for diversifying your money, each of which can contain certain limitations. Real estate might now offer liquidity of your money, especially in a declining economy. Gold and precious metals tend to go up and down in value opposite of the stock market. Collectibles can require focused knowledge and have other challenges. Always consult your financial professional to review the pros and cons when investing in different asset classes.

Nobody knows where the stock market is headed next, but being proactive and learning about the possibility of annuities, like many investors already are, may be beneficial to your portfolio.

&l;em&g;Investment Advisory Services offered through Retirement Wealth Advisors (RWA), a Registered Investment Advisor.&a;nbsp;Riedmiller Wealth&a;nbsp;Management&a;nbsp;and RWA are not affiliated. Investing involves risk, including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Opinions expressed are subject to change without notice and not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.&l;/em&g;

&l;em&g;Annuity guarantees rely on the financial strength and claims-paying ability of the issuing insurer.&a;nbsp;Any comments regarding safe and secure investments and guaranteed income streams refer only to fixed insurance products. They do not refer, in any way, to securities or investment advisory products. Fixed insurance and annuity product guarantees are subject to the claims&a;#8208;paying ability of the issuing company and not offered by RWA. DT491524-0519&l;/em&g;&l;/p&g;

Gevo, Inc. (NASDAQ:GEVO) reached a new 52-week high and low on Friday . The company traded as low as $0.22 and last traded at $0.23, with a volume of 20863 shares changing hands. The stock had previously closed at $0.27.

Gevo, Inc. (NASDAQ:GEVO) reached a new 52-week high and low on Friday . The company traded as low as $0.22 and last traded at $0.23, with a volume of 20863 shares changing hands. The stock had previously closed at $0.27. Source: Apple website

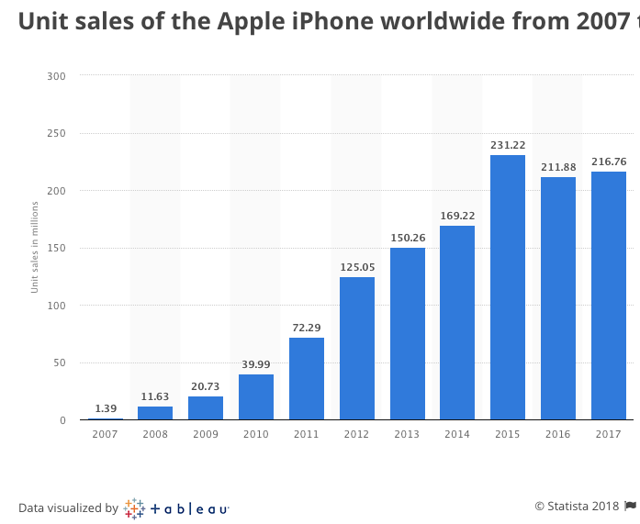

Source: Apple website  Source: Statista

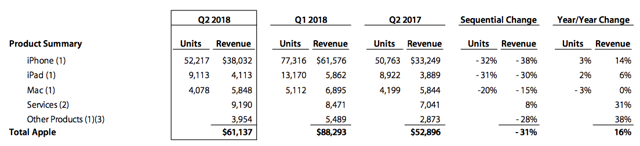

Source: Statista Source: Apple FQ1'18 data summary

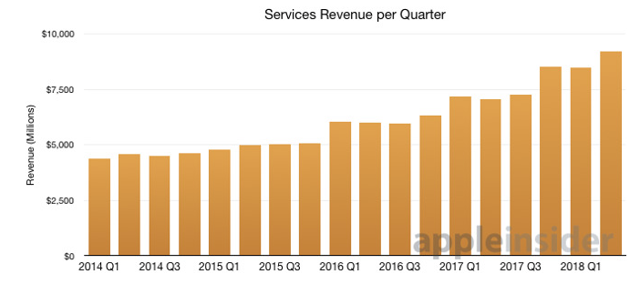

Source: Apple FQ1'18 data summary Source: appleinsider

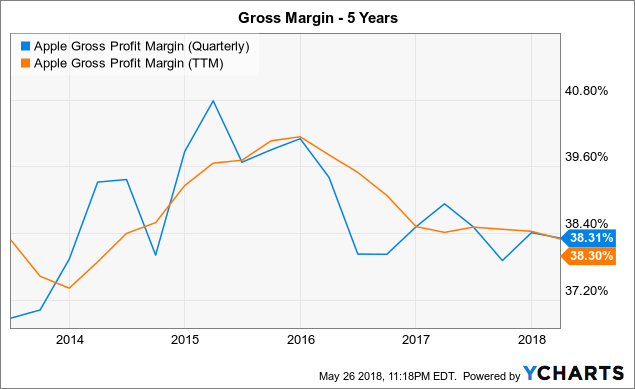

Source: appleinsider AAPL Gross Profit Margin (Quarterly) data by YCharts

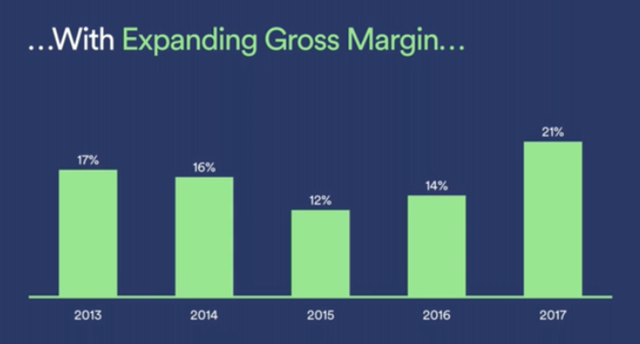

AAPL Gross Profit Margin (Quarterly) data by YCharts Source: Spotify Investor Day 2018

Source: Spotify Investor Day 2018

Speed Mining Service (CURRENCY:SMS) traded 4.2% higher against the dollar during the 24 hour period ending at 0:00 AM E.T. on May 20th. One Speed Mining Service token can now be purchased for $16.33 or 0.00192074 BTC on cryptocurrency exchanges including CoinExchange and HitBTC. Speed Mining Service has a market capitalization of $1.71 million and $413.00 worth of Speed Mining Service was traded on exchanges in the last 24 hours. Over the last seven days, Speed Mining Service has traded 4.2% lower against the dollar.

Speed Mining Service (CURRENCY:SMS) traded 4.2% higher against the dollar during the 24 hour period ending at 0:00 AM E.T. on May 20th. One Speed Mining Service token can now be purchased for $16.33 or 0.00192074 BTC on cryptocurrency exchanges including CoinExchange and HitBTC. Speed Mining Service has a market capitalization of $1.71 million and $413.00 worth of Speed Mining Service was traded on exchanges in the last 24 hours. Over the last seven days, Speed Mining Service has traded 4.2% lower against the dollar.