My previous research placed the services business as a prime catalyst and reason for supporting the $100 billion share buyback plan of Apple (AAPL). Morgan Stanley upped their price target to $214 on optimism for this divisions growth as the margins on the business could provide a boost to profits that go far beyond the revenue contribution.

Source: Apple website

Source: Apple website

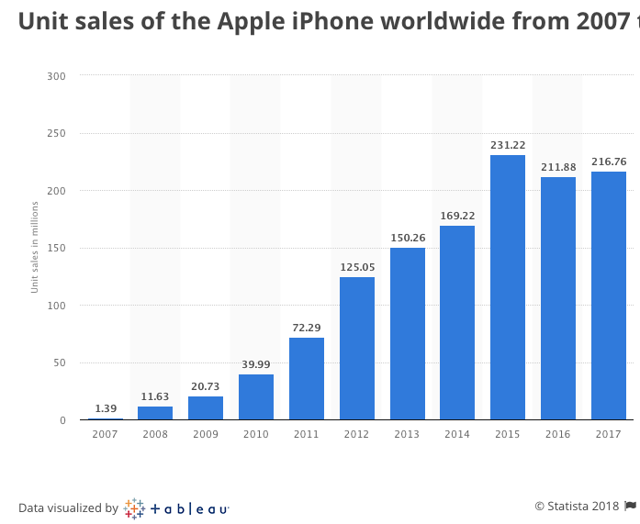

As Apple reaches for a market valuation of $1 trillion, a lot of fears exist that iPhone sales have peaked. The tech giant is getting more per phone via a higher average selling price or ASP, but Apple saw units sold peak back in 2015.

The quarterly peak was 78 million units sold back in FQ1'17, but the company has seen limited growth since FQ1'15 when 74 million units were sold. The annual units sold did peak in 2015 at 231 million units and dipped to 217 million units last year.

Source: Statista

Source: Statista

While worldwide smartphone sales are forecast to continue growing with the spread of high-speed internet access around the world, the amount of consumers able to afford an $700+ iPhone isn't expected to expand materially. For this reason, Apple has spent the last couple of years trying to increase the ASP with phones like the iPhone X with a listed price above $1,000.

In the quarter ended March with a full quarter of iPhone X sales, iPhone revenues grew far in excess of units sold. The ASP grew to $734, up from $655. For this reason, iPhone revenues surged 14% on a meager 3% growth in units.

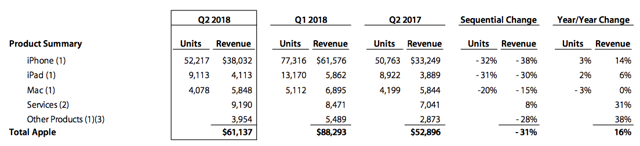

Source: Apple FQ1'18 data summary

Source: Apple FQ1'18 data summary

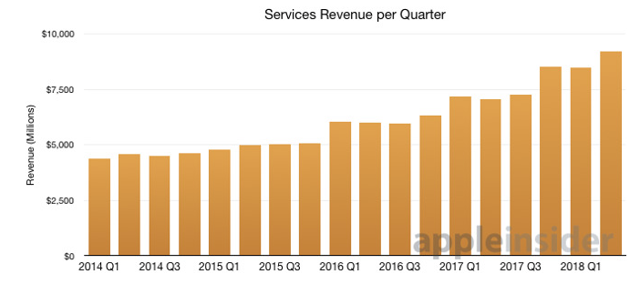

The fears exist that Apple won't be able to continue expanding ASPs requiring a future catalyst beyond hardware. While possibly not even true, the key for investors is that the tech giant already has a business unit that has evolved into a massive division. Since the start of 2014, Services have grown revenues from under $5 billion per quarter to over $9 billion in most recent quarter. Even better, the growth is steady unlike hardware sales that require new products every year.

Source: appleinsider

Source: appleinsider

Even better, the growth is steady unlike hardware sales that require new products every year.

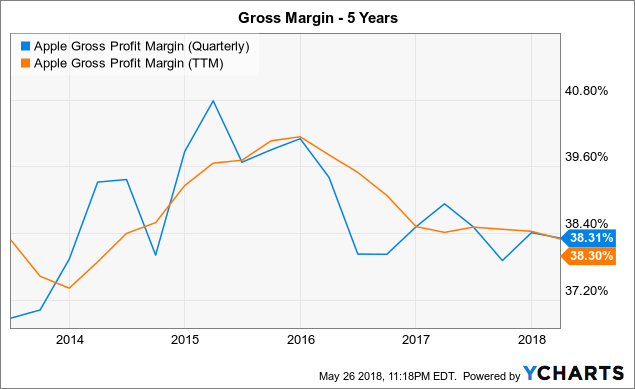

Accretive MarginsThe thesis for Morgan Stanley analyst Katy Huberty hiking the Apple price target to $214 from $200 is the strong margins from services. The company doesn't provide a lot of details other than the knowledge that gross margins have averaged around 39% over the lat 5 years.

AAPL Gross Profit Margin (Quarterly) data by YCharts

AAPL Gross Profit Margin (Quarterly) data by YCharts

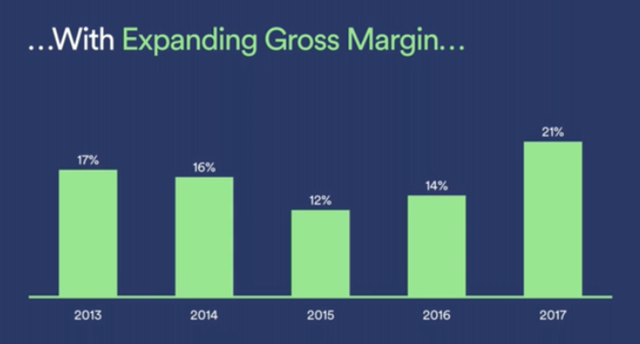

Historically, services generate higher margins from the recurring revenues versus selling one unit every few years. The company though has several service businesses from the App store to Apple Music. The recent IPO of streaming music service Spotify (SPOT) brought some attention to the low margins in that unit that were probably extrapolated far too much in the case of Apple.

Spotify only forecasts generating margins in the 25% range this quarter so obviously this figure is far below the corporate level of Apple and the tech giant has fewer subscribers than Spotify. Investors looking at the historical margins of Spotify might extrapolate those to the rest of the services business.

Source: Spotify Investor Day 2018

Source: Spotify Investor Day 2018

Katy Huberty projects that the services division actually generates a 50% gross margin with operating margins above 40%. Growth in services will help drive higher margins in the overall business.

Apple CFO Luca Maestri made claims on the recent FQ2 earnings call that the division does generate higher margins than the corporate average currently in the 38.5% range:

Gross margin was 38.3%, essentially flat sequentially, as we offset the seasonal loss of leverage with cost improvements and a shift in mix toward services...Our services business, and I've said it in the past, is accretive to company margins. And so as we are able to grow the services business, that should provide a positive, a tailwind.

Hubert believes services will grow from 22% of gross profit dollars in FY18 to 40% of gross profit dollars by FY22. Just keeping the remaining business flat, Apple would see a $20 billion boost to gross profits.

Combined with a $100 billion share buyback that reduces share counts by over 10%, Apple will still see a big EPS boost even if the hardware business flat lines. Based on operating margins that reach 45% and the 15% tax rate, the EPS would see about a $1 per share jump each year from services gross profit growth of about $5 billion annually. By FY22, EPS could expand $4 from growth in services alone.

The impact might turn larger if Apple reduces the share count beyond 10%. The current buyback would cut shares outstanding from 5.07 billion to closer to 4.50 billion shares, but the tech giant will generate close to $60 billion in free cash flow annually that can keep the buyback going each year.

TakeawayThe key investor takeaway is that Apple is shifting away from a reliance on the iPhone business. The highly profitable services business could easily approach 50% of profits in the next five years far before reaching the scale of the iPhone.

All margins aren't equal and this fact will benefit Apple shareholders over the next few years while the market wrongly focus on peak iPhone sales. The stock trades far too cheap at 14x FY19 EPS estimates for a business that could approach 50% of profits from services by FY22.

Disclosure: I am/we are long AAPL.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

No comments:

Post a Comment