The Federal Reserve remains “patient” and the stock market remains up — for now. Investors are looking for a reason to book some profits into possible resistance, but can’t decide if the Fed report is reason enough to do it. Other than that, we have a few top stock trades to watch for Thursday.

CVS Health (CVS)

Click to Enlarge

Despite beating on earnings estimates, shares of CVS Health (NYSE:CVS) are lower after management’s less-than-thrilling outlook.

Fortunately, CVS’s charts are relatively straightforward. Sellers line up near $80 and buyers get in line in the low $60s. So far, the low for this year is near $62.50. There’s a bit of trend support nearby as well (blue line) at $63.

However, should $62 give way, We could see that $58 to $60 level CVS stock traded at last April. I’m not a dip-buyer in CVS, but these are the levels for bulls to keep in mind.

Compare Brokers

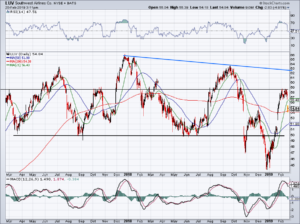

Southwest Airlines (LUV)

Click to Enlarge

Higher-than-usual grounding of its fleet is causing concern for investors, who sold Southwest Airlines (NYSE:LUV) lower by 5% on Wednesday.

Wednesday’s lows hit the 50% retracement from Southwest’s 52-week range. In short, it’s not easy to define its trading setup; shares are smack-dab in the middle of its annual range and they have no real trend to speak of. Those looking to buy will need to see it stay over the 200-day moving average. While this level hasn’t played a huge role over the past few years, it did on Wednesday.

Below, it opens the floodgates down to the 50-day moving average, a decline of more than 5.5%. Ultimately, I would rather pass on Southwest unless it gets down toward $50. Near that price, investors show it plenty of “LUV.”

Compare Brokers

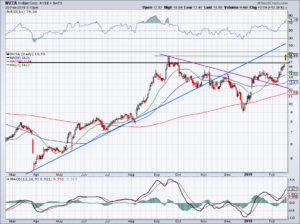

Invintae (NVTA)

Click to Enlarge

Man, did Invintae (NASDAQ:NVTA) blow out the numbers or what? The company’s quarterly results were wildly impressive and Wall Street is rewarding investors on Wednesday, up almost 14% after an already huge rally.

At the beginning of the month, I noted the stock’s breakout over $15 and said it could run to $18 if the bulls maintain momentum. $3.75 per share later and the stock is logging new highs. It’s hard to chase here, but the story is great and if we get a pullback, bulls may consider buying this one.

Will we see a push toward $20 before that happens? Maybe. If so, look for $18 to be support on a pullback. If we pullback first, look for the breakout over $16.75 to $17 to act as support.

Compare Brokers

Henry Schein (HSIC)

Click to Enlarge

Shares of Henry Schein (NYSE:HSIC) used to be very consistent, but that hasn’t been the case over the last few years. Despite beating earnings estimates on Wednesday, shares fell over 5% on the day.

Down near $57 to $56.50, dip buyers may find the risk/reward attractive. But this one is lagging any sort of momentum or support near current levels. Over $61 — with all three major moving averages near $60.50 — and it looks better. Otherwise, let’s wait for lower.

Compare Brokers

Baidu (BIDU)

Click to Enlarge

Chinese stocks have been on the move lately and Baidu (NASDAQ:BIDU) has been coming back to live. Honestly, nibbling right here isn’t a bad setup with investors able to pull the plug on a close below the 50-day moving average.

However, a push over the $175 level could trigger a move to $180. Should BIDU push through this mark, a rally up to $195 could ultimately be in the cards.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing,

No comments:

Post a Comment