Back in January, we wrote about why we thought Caterpillar (CAT) was a solid investment opportunity. Since then the stock is down 15% and famed short seller Jim Chanos has announced he's short the stock. Chanos thinks the company has too much exposure to the wrong products at the wrong place in the cycle.

Chanos got a big win when CAT announced 2Q EPS. The numbers proved dismal and yet another downward guidance was made. However, we are taking the longer view, i.e. out to 2015, and believe that the stock is offering investors impressive upside.

2Q Earnings

EPS of $1.45 compared to $2.52 for the same period last yearEPS was 14% below consensusRevenues were down 16% year over yearCut its 2013 revenue guidance from $57B-$61B to $56B-$58BFull year 2013 EPS guidance was down to $6.50 from $7.00Segments

Construction Industries saw sales down only 9% year over year. The big tailwind for this segment going forward should be a rise in U.S. residential and nonresidential construction. Meanwhile, Brazil has solid demand thanks to World Cup and the Olympics, where the country is building out infrastructure. CAT is also seeing improvement in China, as the money supply increasing has boosted infrastructure spending. Resource Industries is the real problem child for the company. Sales were down 34% year over year, with sales down in every region, and being down the most in its Asia-Pacific region. 2013 mining segment revenues are expected to be down big given major mining companies are planning to continue their CapEx cuts. Power Systems is one of its underrated segments. Sales were down 4.5% year over year. Asia-Pacific experienced solid growth thanks to strong drilling activity in Australia. Some of the best opportunities lie in offshore drilling in Brazil, the Middle East and Latin America.Let's dig into some numbers...

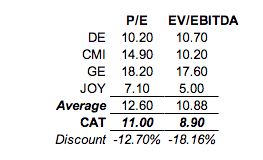

CAT is trading well below some of its major equipment peers.

10 Best Low Price Stocks To Invest In Right Now

What's more is that the stock is trading at a steep discount on a P/E basis (at 11x) to its five-year 19x average. While we don't see CAT returning to the 19x earnings anytime soon, we do feel that the stock shouldn't be trading at 9x 2015E EPS (more on this later).

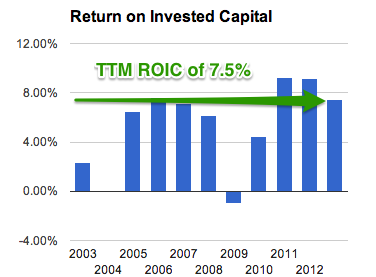

Despite the recent setbacks, CAT still has a return on invested capital that's very close to pre-crisis levels.

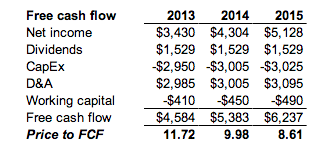

We think the free cash flow rebounds for the company, where it's currently trading at 8.6x FCF.

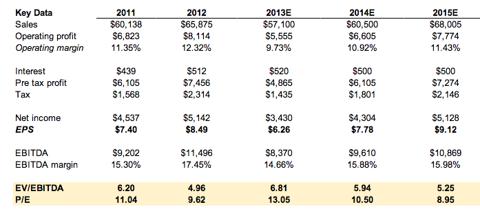

The big driver for the rebounding of FCF should be a rebound in sales. Although we see its operating margin further contracting for fiscal 2013, we expect a steady rebound. Based on our 2015E EPS of $9.12, the company is trading at a mere 9x earnings and a 5.25x EV/EBITDA multiple

(click to enlarge)

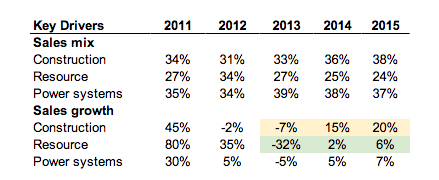

We see CAT's EBITDA margin reaching 16% in 2015, which is still well below the near 17.5% in 2012. The reason for the contraction is the fundamental shift from a resource-heavy revenue stream to more construction. Outlined below are the key sales drivers.

Note that we see construction revenues going from 31% of total revenues in 2012 to 38% in 2012, while resource revenues go from 34% of total revenues in 2012 to 24% 2015.

Behind the revenue mixes is distinct sales growth. Highlighted above, in yellow, is where we see construction overtaking resource, while resource revenues should see an over 30% revenue decline in 2013 (highlighted in green).

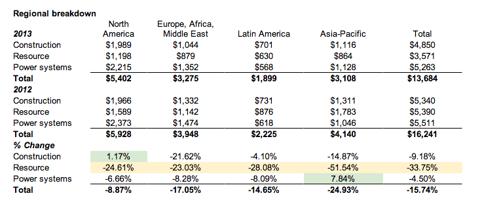

Diggin! g even de! eper, we believe the biggest fall in revenues for the resource industry will be tied to the Asia-Pacific region (highlighted in yellow below). Meanwhile, the only areas of growth we see for 2013 will come from the construction segment of North America and the power systems segment in Asia (highlighted in green).

(click to enlarge)

All in all / Valuation

In the end, we're still very long CAT. The balance sheet is in good shape, with a rising cash balance, now over $6 billion. We like the 2% plus dividend. As far as valuation goes, our quick thesis includes the fact that CAT trades at less than 10x earnings, compared to the peer average of 12.6x and the broader industry average of 17x. Placing a more appropriate 13x P/E on our 2015 EPS estimates suggest upside of nearly 45% at a $120 price target.

Disclosure: I am long CAT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment